With the recent collapse of the #FTX exchange, we have undertaken studies to assess the scale and relationship of on-chain flows over the last 1yr.

The following thread covers 🧵

- Fund flows between #FTX, #Alameda, #Binance

- The complete decline of #FTX exchange reserves

Over the last year, since the market ATH, #Ethereum wallets associated with #Alameda Research have primarily interacted with two entities, weighted by all token USD value transferred:

- FTX = ~90%

- Binance = ~9%

- Other = ~1%

When we observe the total inflow patterns into #FTX, #Alameda is by far and away the largest entity depositing funds when compared to other inter-exchange transfers.

Since 8 Nov 2021, #Alameda has deposited a cumulative total of $49B+ worth of tokens to #FTX.

The primary tokens flowing in and out of #Alameda wallets are those considered to be higher quality collateral:

- Stablecoins (USDC, DAI, USDT and HUSD)

- $ETH

- $WBTC

Typical #Alameda on-chain balances were held at around $200M on average, with the wallets being very active.

The source of funds flowing into #Alameda wallets were similarly skewed towards #FTX and #Binance, accounting for cumulative values of:

FTX --> Alameda = $7.1B

Binance --> Alameda = $15.5B

For the funds flowing out of #FTX to other exchange venues, we again see significant dominance between #FTX, #Alameda and #Binance.

FTX --> Binance = 36% of flows

FTX --> Alameda = 38% of flows

In general suggests that Alameda may have been in between a great many transfers from Binance --> Alameda --> FTX (and vice versa).

It also highlights that these two venues were the primary trading venues for Alameda strategies.

As the bank run at #FTX ensued over the last 48-hours, #FTX exchange reserves declined dramatically, and almost completely.

FTX $ETH reserves declined from over 611k $ETH, to just 80k $ETH in 2 days.

Stablecoin reserves also fell precipitously, dropping from a typical range of $700M to 800M in mid-October, to effectively zero today.

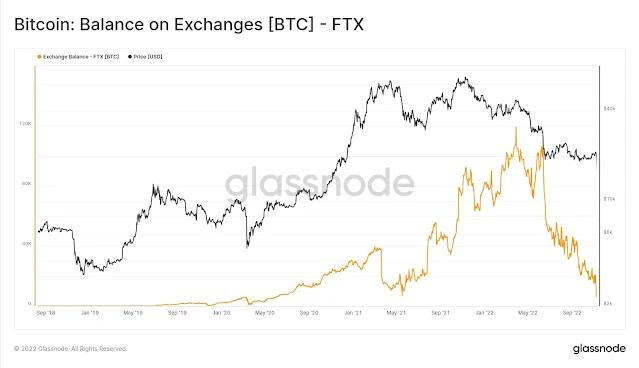

Similarly, the #FTX #Bitcoin balance has declined to effectively zero, after topping out at 108k $BTC in late March.

Reserves started to fall significantly immediately following the LUNA collapse, suggesting a degree of balance sheet impairment following that event.

It remains an extremely challenging event for the market, with hits to market prices, investor confidence, and impacts yet to be uncovered

We at glassnode feel for all of those affected, and wish each of you the very best.

We'll continue to monitor and report on-chain flows.

0 Comments