With the devastating collapse of the FTX exchange, the digital asset industry has experienced the most shocking insolvency of a custodian since Mt Gox. In this report, we analyze the FTX bank run, seeking of safety in self-custody, and the response of Bitcoin's strongest hands.

The events which transpired in the digital asset industry, between 6-14 November 2022 are nothing short of remarkable, shocking, and disappointing, to say the least. Within the span of just one week, one of the most popular and high trade volume exchanges, FTX.com;

- Experienced a bank run.

- Halted customer withdrawals.

- Entered into failed talks to be acquired by competitor Binance.

- Discovered to be short between $8B to $10B in customer funds.

- Had exchange wallets allegedly hacked to the tune of ~$500M.

- Filed for Chapter 11 bankruptcy alongside sister company FTX US.

- Exposed what appears to be malfeasance perpetrated by the Alameda / FTX entity.

Such an event is a tremendous blow to the industry, leaving millions of customers with trapped funds, damaging many years of constructive industry reputation, and creating new credit contagion risks, many of which likely still remain undetected. The event brings back unfortunate memories of the failure of Mt Gox in 2013, whereby a significant custodian is found to be fractionally reserved.

Amidst this chaos, it is important to remember that the digital asset space is a free market, and this event represents a failure of a trusted centralized entity, not of the underlying cryptographic technology. There are no bail outs for Bitcoin, and the forest fire of an industry wide deleveraging will purge all excess and malfeasance, albeit with significant pain along the way. With a renewed focus on exchange Proof-of-Reserves underway, and a push towards self-custody, the market will heal, recover, and return stronger in the months and years ahead.

In this weeks report, we will cover:

- Details regarding the bank run on FTX on-chain wallets.

- Wider impact on exchange balances and self-custody.

- Observations the impacts to Bitcoin long-term holder conviction.

Fractional Reserves

The truth regarding how FTX managed to blow a hole between $8 to $10B in their balance sheet, and lose customer deposits will (hopefully) come to light in time, although much evidence suggests a misappropriation of funds via sister hedge fund Alameda Research. For background information, and analysis on the relationship between Alameda, FTX and Binance, we refer readers to the following sources:

Tracking the exchange reserves for FTX has been somewhat of a challenge for many data providers over the years, with our own experience being that FTX utilized a relatively complex peeling chain system for their BTC reserves. In April to May this year, the FTX reserves within our cluster had reached a peak of over 102k BTC. This dramatically declined by 51.3% in late-June.

Reserves have since persistently declined until reaching effectively zero during this weeks bank run. As claims of Alameda misappropriating customer deposits come to light, this indicates that the Alameda-FTX entity may have in fact experienced severe balance sheet impairment in May-June following the collapse of LUNA, 3AC, and other lenders.

The supply of ETH held on FTX has also experienced two periods of significant decline:

- In June, where reserves dropped by -576k ETH (-55.2%)

- This week, falling from 611k ETH to just 2.8k (-99.5%)

Similar to the Bitcoin balance, this leaves close to no ETH in FTX owned wallets, with the bank run effectively clearing what was left from the balance sheet.

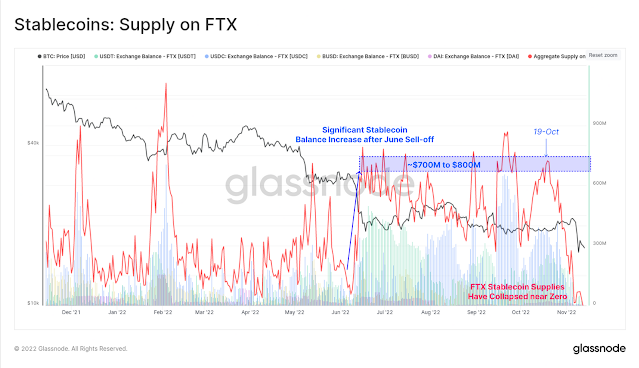

When looking to stablecoin reserves, we can see that aggregate reserves on FTX started to decline significantly from 19-Oct, dropping from $725M, to effectively zero over the following month.

Stablecoin balances spiked significantly to a new sustained height after the June sell-off, at a time where BTC and ETH reserves had dropped precipitously. This may add further indication that a degree of balance sheet impairment had occurred at that stage, necessitating a swapping or lending of stablecoins for BTC and/or ETH collateral.

Whilst there remains significant uncertainty regarding what really happened between FTX and Alameda, there remains a growing pool of on-chain data to suggest cracks had formed as far back as May-June. This would leave recent months as being simply a precursor to what was more than likely an inevitable collapse of the exchange.

💡 New Dashboards Released

We have released tho new dashboards which explore changes in Bitcoin cohort size, and balances as a toolbox to observe investor behaviour. The following charts are sourced from our Entity Balance Change dashboard (T3), and can be supplemented by our Address Cohorts Dashboard (T2).

Safety in Self-Custody

On an industry wide scale, we have seen a withdrawal of coins from exchanges at a truly historic rate, as holders seek the safety of self-custody. The following charts map out the aggregate balance change of exchanges, investor wallet cohorts, and miners since the 6-Nov, when rumblings of troubles at FTX were still in their infancy.

Exchanges have seen one of the largest net declines in aggregate BTC balance in history, falling by 72.9k BTC in 7-days. This compares with only three periods in the past; Apr-2020, Nov-2020, and June to July 2022.

A similar observation can be made for Ether, with 1.101M ETH being withdrawn from exchanges over the last week. This makes for the largest 30-day balance decline since September 2020 during the peak of 'DeFi Summer', where demand for ETH was sky high for use as collateral in smart contracts.

Whilst BTC and ETH exchange reserves declined this week, stablecoins have on net flowed into exchanges, with over $1.04B in combined USDT, USDC, BUSD and DAI flowing in on 10-Nov. This makes for the 7th largest daily net inflow in history.

This has pushed stablecoins held across all exchange reserves to a new all-time-high of $41.186B. We can also see a notable increase in BUSD dominance, with over $21.44B held in exchange reserves. This is likely a result of Binance's recent stablecoin consolidation towards BUSD, as well as its growing dominance as the largest exchange in the world.

USDT exchange reserves have declined slightly, and USDC reserves more dramatically over recent months, indicating a potential shift in market preference is underway.

Interestingly, a great deal of these stablecoins are being sourced from smart contracts, and have been withdrawn from Ethereum smart contracts at a rate of $4.63B per month. This acts to highlight how acute the demand for immediate dollar liquidity has become.

As a result, the market has entered an interesting state, whereby centrally issued stablecoins are flowing into exchanges, whilst the two major crypto assets, BTC and ETH are being withdrawn at historic rates. The chart below is a two part model reflecting the following:

- A lack of 🟧 in the barcode trace indicates that exchanges have seen a net BTC + ETH outflow.

- The oscillator shows the net inflow of stablecoins, minus the net USD flow of BTC + ETH. For positive values 🟢, it indicates an excess of stablecoin 'buying capacity' has flowed into exchanges.

Here we can see that overall, the net buying power of stablecoins on exchanges has increased by $4.0B/mth. This demonstrates that despite market turmoil, investors appear to favor holding trustless BTC and ETH assets, rather than than centrally issued stablecoins at this time.

This is quite an intriguing signal, and could be argued to be a constructive sign of confidence in the base layer assets, and a case for the market seeking safety in self-custody.

Bitcoin Balances Swell

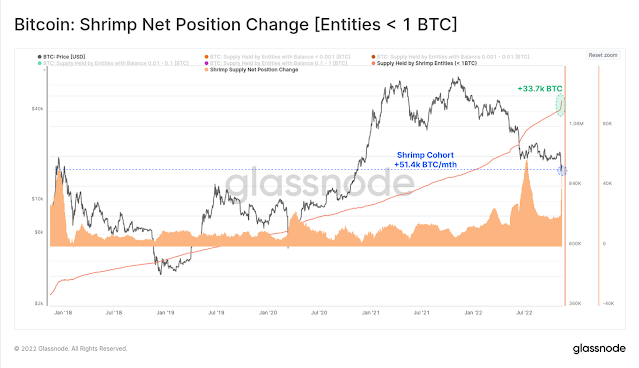

With such large volumes of BTC flowing out of exchanges, we can see that across all wallet cohorts, the FTX event has triggered a distinct change in investor behavior. On-chain wallets, from Shrimp (< 1 BTC) to Whales (> 1k BTC) have experienced a net balance increase 🟦 throughout the FTX collapse. For some cohorts, this has been an almost perfect 180-degree turn from a regime of sustained distribution 🟥 over recent months.

The Shrimp cohort (< 1BTC) have added 33.7k BTC this week alone, resulting in a 30-day increase of +51.4k BTC. This level of balance inflow is the second largest in history, surpassing the peak of the 2017 bull market.

The Crab cohort, with between 1 and 10 BTC are similarly aggressive, pulling 48.7k BTC off exchanges, and approaching acquisition rates in line with the 2017 bull market peak. Entities holding < 10 BTC now command over 15.913% of the circulating supply, a new, and convincing all-time-high.

Wallet cohorts between 10 and 1k BTC are colloquially referred to as Fish, and Sharks. This cohort reflects entities with balances on the order of high net worth individuals, trading firms, and institutional investors.

After several months of slowing balance growth, this week has motivated a significant cohort balance increase of 78.0k BTC, and one of the largest 7-day balance increases in history for this cohort. This likely reflects, in part, a 'withdraw now, ask questions later' mentality.

For Whales, defined as those with > 1k BTC, we have only considered coins directly flowing in and out of exchanges. This is to better reflect true investor activity for these large entities. Whales have actually been net accumulators over recent weeks, with a 30-day balance change of +53.7k BTC.

Their on-net participation over this week however has been an order of magnitude less than other cohorts, with only a modest balance increase of +3.57k BTC.

Lastly on the balance change front, we have Bitcoin miners, who are already an embattled industry, and under extreme stress due to recent coin price declines. As Hash Prices pushes to all-time-lows, miners have been forced to liquidate around 9.5% of their treasuries this week, spending 7.76k BTC. This is the sharpest monthly miner balance decline since September 2018, and demonstrates the pro-cyclical nature of Bitcoin miners.

HODLers Resolve

In the last section of this newsletter, we will cover the response of the Bitcoin HODLers, to inspect whether there has been a discernible loss of conviction. Given the scale of impact, and far reaching consequences of the FTX implosion, if there was a time for HODLers to lose faith in the asset, it is likely now.

Long-Term Holder supply, being that which is statistically the least likely to be spent, has declined by -61.5k BTC since 6-Nov. Approximately 48.1k BTC was spent over the last 7-days, which certainly registers as a non-trivial event. However, given the scale of balance change detailed above, and comparing to historical precedents, it is not yet of a scale to infer widespread loss of conviction. Should this develop into a sustained LTH-supply decline however, it may suggest otherwise.

The chart below presents a 4yr Z-Score of the weekly sum of Revived Supply older than 1yr. Over the last week, 97.45k BTC which were older than 1yr have been spent and potentially returned to liquid circulation.

This represents a +0.83 sigma move on a 4yr basis, which is notable, but not yet of historical magnitude. Like LTH Supply, this is a metric to watch in case it develops into a sustained trend.

The average age per BTC has also climbed to just over 90-days this week, which is triple that observed during the low volatility environment through Sept to Oct. The uptick in older coins being spent is noteworthy, and is in line with peaks seen during previous capitulation sell-off events, and even the 2021 bull market profit taking.

A sustained up-trend or elevated level of Dormancy may indicate a more widespread panic has taken root amongst the HODLer cohort.

Finally, we can return to our 4yr Z-Score construction, but this time for the weekly sum of coindays destroyed (CDD). Here we can see that after a lengthy period of an extremely dormant coin supply, the volume of coinday destruction this week hit +1.9 standard deviations above the mean. A total of 165M coindays have been destroyed this week, which is equivalent to the spending of 452.2k BTC that have been held for 1-year.

Overall, there has certainly been a degree of immediate panic within the HODLer cohort. However, given the magnitude of the circumstances, this is arguably an expected result. What is likely of more interest is whether these spikes soften in coming weeks, which would suggest that this shake-out is more of an 'event', rather than a 'trend'.

On the other hand, a sustained push higher in older coins being spent, and a decline in LTH supply would be clear warning signs that a more widespread loss of conviction and concern may be in play.

Summary and Conclusions

The collapse of FTX is significant, and a real black eye to the industry. It is a truly horrendous event where users of a platform find themselves trapped, and have funds entrusted to a custodian lost. This is sadly a forest fire, and a deleveraging event that was due to happen eventually, and as is tradition, Bitcoin, and the industry will bounce back stronger.

We at Glassnode wish every single one of our readers the very best in these challenging times, and remain extremely confident in the resolve of an industry, which is routinely tested, unlike any other. In times like this, be like Bitcoin; resilient, robust; sound and unstoppable. There is a road of opportunity ahead.

As with all similar disasters of the past, time and dedication will heal the wounds, and this truly free market will learn from the mistakes, grow stronger, and come back more resilient than it was yesterday.

Tick tock, next block.

0 Comments